capital gains tax increase news

Further Biden is proposing a hike to the long-term capital gains rate to 396. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37.

The bottom 99 on.

. Since capital gains tax commenced on 20 September 1985 all assets acquired are subject to CGT unless specifically excluded such as a main residence. I sold stock this past year and had capital gains of 183740. September 15 2021 455 PM MoneyWatch.

The proposal would set the capital gains tax rate for individuals earning over 1 million at 396 percent two people familiar with the plan told Bloomberg. Major income tax changes in last 10 years and how they have impacted your investments. President Biden is expected to announce a proposal to nearly double the capital gains tax rate in order to help fund a forthcoming spending package according to multiple reports.

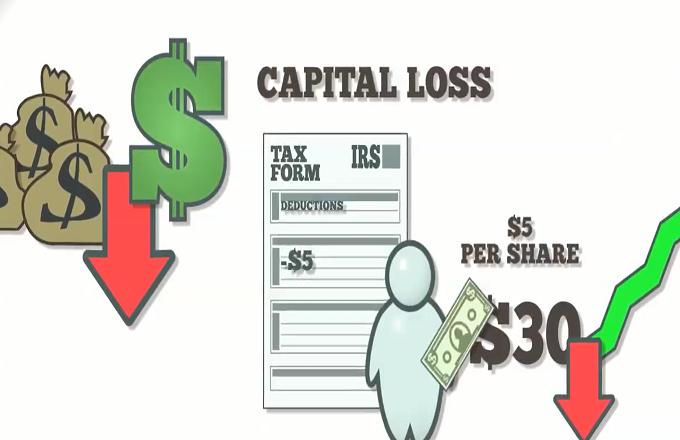

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. Proponents of Mr.

The GOP remains resolute against. Wealthy Americans now paying the top capital gains rate could see a hike to 434 from 238Both rates include a 38 levy on net investment income created by. The White House will this week propose nearly doubling taxes on capital gains to 396 for people earning more than 1 million Reuters and.

In Tax Year 2021 The 0 Tax Rate On Capital Gains Applies To Married Taxpayers Who File. One of the changes announced was in April 2018. Biden may call for increasing the top capital gains tax to 396 percent plus the surtax sources told NBC News.

When combined with an. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. Capital gains tax is charged on a disposal of residential property that is not your main residence at 18 per cent basic rate taxpayers.

Hed like to raise the top rate on income taxes to 396 from 37. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gains. Bidens tax increases say Americas richest citizens can afford to pay more.

It was announced that long-term capital gains beyond Rs 1 lakh from stocks equity funds. The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35 trillion budget. The effective date for this increase would be September 13 2021.

While 100000 is real money it will be paid by a group of people who earn an average of 22. Proponents of the increase say bringing taxes on investment income in line with. By Naomi Jagoda - 072421 500 PM ET.

While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. Without tax free capital gains for homeowners the property asset class may not have evolved into one the entire financial system is now dependent on. While it technically takes effect.

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Lily Batchelder Lilybatch Twitter

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Who Is Exempt From Paying Capital Gains Tax

Capital Gains Accounting And Finance Capital Gain Bookkeeping And Accounting

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Selling Stock How Capital Gains Are Taxed The Motley Fool

Can Capital Gains Push Me Into A Higher Tax Bracket

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

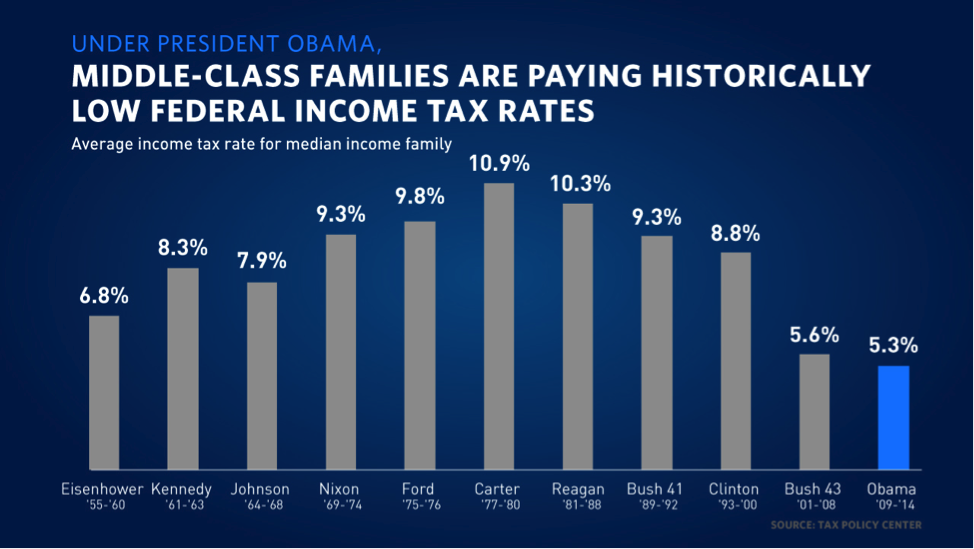

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)